Crypto Earning Start with Yield Farming

Encrypting your link and protect the link from viruses, malware, thief, etc! Made your link safe to visit. Just Wait...

DeFi is an up-and-coming point in the crypto world. Indeed, it's hot to such an extent that in November 2020, the absolute estimation of secured in the DeFi area had hit an astounding $13,6 billion.

As of late, AirdropAlert began a progression of blog entries devoted to procuring crypto inside this arising industry. We recorded some very rewarding approaches to assist you with excursion discovery away, and in this blog entry, we'll jump profound into procuring crypto with yield cultivating. Above all, how about we clarify what it really is.

What is yield farming?

Yield cultivating is quite possibly the most famous, anyway simultaneously exceptionally hazardous, utilization of decentralized account. It is the way toward loaning cryptographic forms of money and, consequently, creating high benefits or awards from other digital currencies. Initially, the most famous cryptographic forms of money for yield cultivating were steady coins like USDT and DAI. Over the long run, DeFi conventions extended to the Ethereum organization and began to remunerate clients with administration tokens for liquidity mining. These tokens would then be able to be exchanged on crypto trades, both brought together and decentralized.

Does this depiction sound recognizable? Possibly something like marking? Indeed, the distinction between the two can be somewhat hazy. Allow me to clarify.

As opposed to marking, yield cultivating is a more unpredictable cycle. Marking ordinarily chips away at the PoS agreement system with an irregular determination measure and marking rewards paid by the financial backers on the stage. On the opposite side, yield cultivating keeps financial backers' assets in purported loaning pools, with borrowers loaning assets as a trade-off for advantages.

Since we understand what it is and how it varies from marking we should investigate the five most famous stages where you can begin acquiring crypto.

5 most mainstream stages for yield farming.

There are an assortment of DeFi stages where you can begin with yield cultivating. Each has its own principles for boosted loaning and getting from liquidity pools. Each additionally has its own benefits and disadvantages. Thus, right away, here are the five most famous yield cultivating stages:

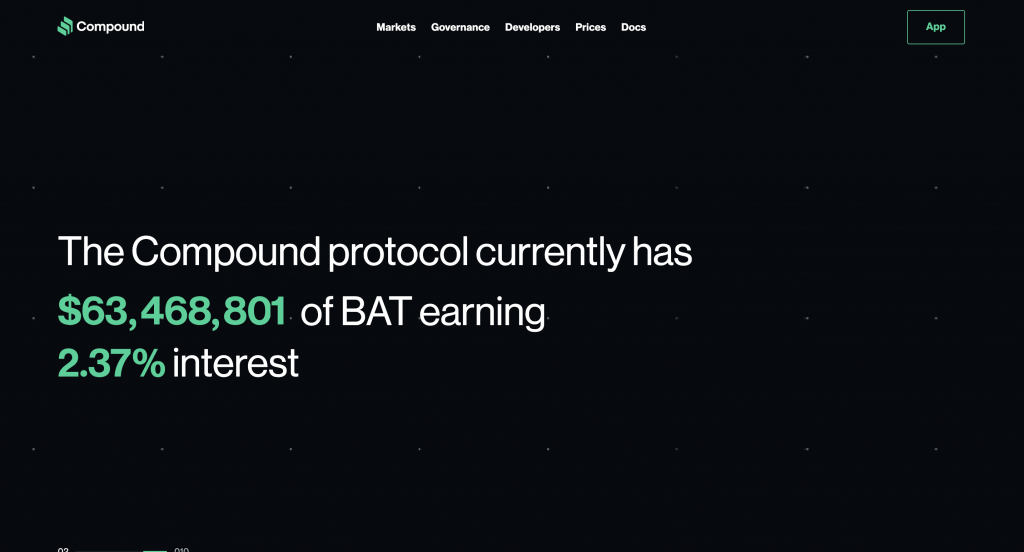

Compound. A famous stage for loaning and getting resources with its own administration token called COMP. Accumulate is an algorithmic, self-sufficient loan cost convention focused on both yield cultivating novices and progressed clients.

MakerDAO is perhaps the most and mainstream and most established DeFi project in the crypto business. It's a USD-fixed stablecoin run on Ethereum blockchain, permitting clients to bolt crypto as insurance resources. Interest is paid as a supposed dependability charge.

Aave. Previously known as ETHLend, Aave is one of the main loanings and getting conventions in the realm of DeFi. The stage permits clients to get credits without guarantee, and, right now, it has a bolted estimation of more than $1,5 billion.

Uniswap, a well-known decentralized trade, permitting clients to trade a wide scope of ERC20 tokens with no go-betweens. With Uniswap, clients can acquire a level of exchange expenses and the UNI administration token.

Balancer. A yield cultivating stage that permits suppliers to make redid pools with token proportions that may contrast. Balancer separates itself from other comparative stages by charging expenses to merchants, who rebalance their portfolio and follow exchange openings.

Other mainstream yields cultivating stages worth investigating are Synthetix, Yearn. finance, Curve, Harvest, Ren, and SushiSwap.

Don't neglect to remain safe

In the event that you choose to plunge profound into this worthwhile area, remember that albeit exceptionally rewarding, it likewise conveys a critical danger for the two borrowers and loan specialists. It can even prompt temporary monetary misfortune, particularly during the time frames when markets are unstable.

Furthermore, yield cultivating is powerless to different hack assaults and fakes. This regularly occurs because of possible weaknesses and bugs in brilliant agreements. For example, in October 2020, Harvest. Finance lost more than $20 million of every liquidity hack.

Make certain to deal with your assets and stay protected during yield cultivating.

0 Response to "Crypto Earning Start with Yield Farming"

Post a Comment